Portfolio Update: Full Speed Ahead For Another American Century

Since August, the I&F Portfolio is up more than 70% and has outperformed the S&P 500 by 50%, thanks to stellar performances of AppLovin (APP), Rocket Lab (RKLB), Esperion Therapeutics (ESPR), Navitas Semiconductor (NVTS) and Verona Pharma (VRNA), among others.

This is not financial advice and is for entertainment purposes only. Do your own due diligence. The author holds a beneficial long position in all companies mentioned except Palantir Technologies Inc. (PLTR). All stock price gains/losses are as of December 6, 2024 after market close. The author receives no compensation for writing this article and has no business relationship with any of the companies mentioned.

It has been almost four months since I launched the Innovation & Freedom Portfolio (external link: Snowball Analytics) on August 11, 2024 (read the inception article here). My mission remains the same: to beat the Street by picking stocks that focus on the innovative power of capitalism and freedom. So far, the I&F Portfolio is up more than 70% and has outperformed the S&P 500 by 50%, thanks to stellar performances of AppLovin (APP), Rocket Lab (RKLB), Esperion Therapeutics (ESPR), Navitas Semiconductor (NVTS), and Verona Pharma (VRNA), among others.

What I added to the I&F Portfolio

On October 16, I added Dutch company ASML, the maker of EUV lithography systems that enable the manufacturing of the high-end chips with single-digit nanometer transistors that are powering the current AI revolution. If you are looking for a company with a technological moat, here you go: I very much doubt that anyone will be able to copy this technology in the next years. Even if tensions between the U.S. and China and over Taiwan were to rise, this would only accelerate the reshoring of chip production to the Americas, thereby increasing demand for ASML's lithography systems (+3%).

I added Navitas Semiconductor (NVTS) on November 15 as an aggressive bet on the future of gallium nitride semiconductors. These wide band-gap semiconductors enable more energy-efficient power supplies and could become widely used not only in small consumer devices, but also in powering AI data centers. The stock's stellar performance in the short time since my pick has surprised even me (+103%).

As I have argued in previous articles, I believe the first industry to experience a huge increase in efficiency through AI is the software industry. GitLab's (GTLB) DevSecOPs platform combined with GitLab's AI assistant, GitLab Duo, is in pole position to become an indispensable hub for enterprise customers for AI-driven software development (added December 3, +5%). Critics of the current AI hype have always argued that generative AI lacks true creativity and produces generic results through mere statistics. As I recently argued, this does not diminish the efficiency gains from AI because most human jobs are not really creative. Besides programming, legal texts and contracts come to mind: Docusign (DOCU) is in the starting blocks here with its tools for AI-assisted contract management, reducing the workload of expensive corporate legal departments (added December 3 before ER, +32%).

As with my existing positions in Journey Medical and Verona Pharma (see below), I prefer pharmaceutical companies that launch conventional drugs rather than sophisticated biotech therapies. In my opinion, biotech is often overhyped, especially in oncology, while there is good money to be made in traditional drugs such as Verona's Ensifentrine. Esperion Therapeutics (ESPR), which I added on November 4, is a great example of this (+70%). Esperion's cholesterol-lowering Bempedoic acid has been well received in the U.S. and Europe, bolstered by a study published in the New England Journal of Medicine in 2023.

On November 8, I added Journey Medical's parent company Fortress Biotech (FBIO) and Journey's "sister" Checkpoint Therapeutics (CKPT) to the portfolio (+22%, +26%). In addition to its 48% stake in Journey Medical, Fortress also owns 10% of Checkpoint Therapeutics and could receive royalties if CKPT's Cosibelimab is approved by the FDA. In recent months, Fortress has been valued at a market cap of around $50 million, which alone is less than half the market cap of Journey Medical. However, FBIO also has significant debt. A key moment for Checkpoint Therapeutics and Fortress will be the PDUFA for Checkpoint's anti-PD-L1 antibody Cosibelimab for metastatic squamous cell skin cancer on December 28th. A year ago, Checkpoint received a Complete Response Letter from the FDA related to issues with third-party manufacturing of Cosibelimab. I am optimistic that Checkpoint has resolved these issues and that Cosibelimab will be approved on December 28, but this is a risky binary bet.

Sagimet Biosciences (SGMT) is currently testing its drug candidate Denifanstat in a Phase 2 clinical trial for the treatment of metabolic steatohepatitis (MASH). A study published in The Lancet this fall showed that Denifanstat may slow the progression of liver fibrosis (added December 3, -4%). ARS Pharmaceuticals (formerly Silverback Therapeutics Inc, SPRY) received approval in August for its Epinephrine nasal spray (neffy®) for anaphylaxis. Until now, people with severe type 1 allergies have had to rely on Epinephrine injections. In the long run, I think a nasal spray could become established as a much more intuitive and easier method of administering Epinephrine (added August 14, +12%).

My latest pharma pick on December 6 was RNA vaccine pioneer Moderna (MRNA), which runs counter to my aforementioned caution about investing in biotech. The stock has plunged recently after Trump nominated RFK Jr. to head HHS. In addition, Leerink analysts are warning of disappointing interim results from the CMVictory Phase 3 clinical trial. Maybe I'm missing information here, but it's not clear to me why Leerink is so negative on this trial; so far, Moderna's RNA CMV vaccine seems to be inducing a strong immune response. Also, the current H5N1 avian influenza (HPAI) epidemic in cattle in the U.S. appears to be only one mutation away from being transmissible to humans. With approximately 10% short interest, MRNA could be very sensitive to a new epidemiological situation (+1%).

On November 8, I also added French luxury fashion and crafts company Hermès (HESAY) to the portfolio. I will be writing a full article on this in the near future, but to sum it up, I think Hermès is a great play on the coming AI revolution (+7%).

After spending two weeks in Japan in November, I became aware of the affordable Japanese fashion brand Muji. On December 3, I added its parent company, Ryohin Keikaku (RYKKY), to my portfolio. Muji's minimalist fashion is very much in tune with the zeitgeist, and tourism to Japan seems to be booming right now. Muji's products are already available online in Europe and, fortunately from an investor's point of view, are significantly more expensive than in Japan. I think the brand could soon reach new heights, spurred on by travelers returning from Japan (-2%).

I've been following Palantir since the stock was trading around $5. I never got in because I didn't like the CEO's aggressive behavior and I honestly thought Palantir was a bubble - probably a big mistake, but I've been in the stock market for over a decade and ultimately my gut has never really disappointed me. I see similar potential in the UIPath (PATH) platform to Palantir's AIP. If UIPath can convincingly integrate generative AI (agents) into its automation platform, I see great potential for the stock (added December 2, +2%).

PagerDuty (PD) is a smaller cybersecurity company that specializes in detecting and reporting incidents in server-side applications and SaaS. The strengthening of its partnership with AWS, announced on December 3, prompted me to add the stock (-1%).

Whirlpool Corporation (WHR) may be a bit boring, but I think the U.S. maker of home appliances and especially washing machines could benefit from Trump's tariff policy and interest rate cuts (added December 2, +1%).

What I have held since August

A high-flier in the I&F portfolio continues to be Rocket Lab (RKLB), even though the stock is a sort of binary bet on the Neutron rocket, which is expected to make its first test flights in 2025. I remain bullish on Rocket Lab and admire CEO Sir Peter Beck, who I believe is an engineering genius, but I have reduced the position a bit and taken profits (+383%).

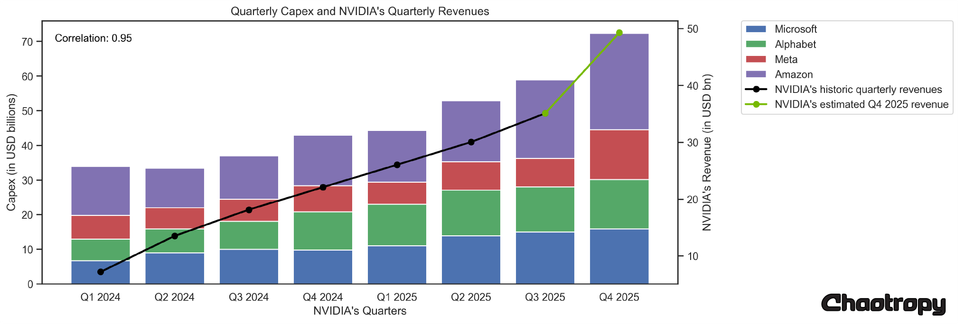

For me, NVIDIA (NVDA) remains at the heart of the current AI revolution (+35%). Today's generative AI models would not be possible without NVIDIA's GPUs. In my view, NVIDIA delivered another great set of results on November 20, and I think it is only a matter of time before the market rewards this and the potential of Blackwell.

Demand for Powell Industries' (POWL) electrification solutions and Modine Manufacturing's (MOD) cooling systems could continue to grow, driven by megatrends such as manufacturing reshoring and new AI data center construction (+68%, +39%).

I was surprised by the performance of AppLovin (APP) (+209%). I have reduced my position but remain bullish. In my opinion, Salesforce (CRM) could benefit enormously from its newly launched AgentForce, which could significantly reduce the workload of the sales force for corporate customers (+43%).

Journey Medical's (DERM) oral rosacea drug DFD-29 (Minocycline 40mg extended release capsules) was approved by the FDA on November 4 and will now be marketed as Emrosi™ (+4%). I am very optimistic that this could become the new gold standard for the systemic treatment of rosacea. Verona Pharma (VRNA) recently showed that its new FDA-approved inhaled COPD drug, Ensifentrine, is gaining traction. I am very bullish on the potential here (+79%).

Green Brick Partners (GRBK) and Toll Brothers (TOL) remain my top picks among US homebuilders. These companies are particularly well positioned to benefit from falling interest rates (-1.4%, +20%).

I hold Northrop Grumman (NOC), the maker of the B21 Raider, as a hedge against tensions in the Pacific (-4%). Kratos Defense (KTOS) remains a top defense pick for me because of its low-cost Valkyrie AI drone (+41%). RTX's missile defense systems are essential to NATO's defense (+1%).

Follow me on X for frequent updates (@chaotropy).