Time To Pick Some Stocks

Time for some optimism: After the recent sell-off, let's call it a bottom and put together a stock portfolio.

This is not financial advice and is for entertainment purposes only. Do your own due diligence. The author holds a beneficial long position in all companies mentioned. The author receives no compensation for writing this article and has no business relationship with any of the companies mentioned.

It's pretty easy to write about individual stocks here and there. The real challenge is beating the Street with a stock portfolio. The Romans used to say, "Hic Rhodus, hic salta!" (Here is Rhodes, jump here!) and meant to show what you can do rather than talk about it. So I created the Innovation & Freedom stock portfolio (external link: Snowball Analytics) on August 11, 2024 - let's see if I can beat the Street. The composition and selection of this pure stock portfolio is risky and is not financial advice. In the following, I will briefly present my current stock picks. For the allocation of individual stock positions, see Innovation & Freedom.

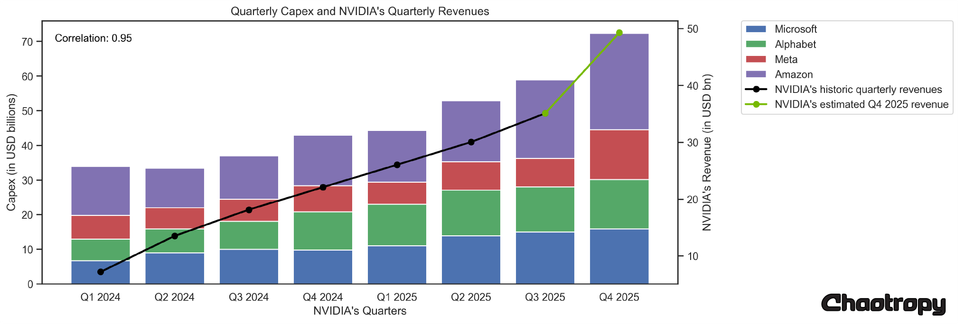

The first two picks, NVIDIA (NVDA) and Apple (AAPL), will not surprise anyone reading this blog. I believe NVIDIA has the potential to crush expectations again on August 28th. I have also written about Apple's positioning in the age of AI, and I believe the iPhone 16 could be one of the most successful generations. I also think that the long-term potential of Apple Vision Pro is underestimated.

Texas-based Powell Industries (POWL) has delivered impressive sales and earnings growth and is poised to benefit from 3 megatrends: Rising electricity demand from AI data centers, the transition to green energy, and the reshoring (and thus automation) of manufacturing. With a forward 12-month PEG ratio of 0.98, I think POWL is a bargain at its current price.

General Thomas A. Bussiere, commander of the Air Force's Global Strike Command, called Northrop-Grumman's (NOC) B-21 Raider the "future backbone of the bomber fleet" in March 2023. The $600 million stealth bomber could become the weapon of choice to deter America's enemies in the 21st century. Another defense contractor to watch is Kratos Defense and Security Solutions (KTOS). The San Diego-based company is developing the XQ-58A Valkyrie, a stealthy unmanned combat aircraft designed to operate alongside fighter jets. At well under $10 million per unit, the Valkyrie could be a very cost-effective weapon. RTX is a well-positioned defense and aerospace company. In the current geopolitical environment, demand for RTX's Patreon systems, which are essential to missile defense, could well continue to grow in the coming years.

Green Brick Partners (GRBK) is a US homebuilder that operates primarily in the booming southeastern US, especially in Texas. Toll Brothers (TOL), on the other hand, is primarily active in the premium housing segment, where it benefits from high margins. CRH is one of the world's leading producers of building materials and cement and should also benefit from the construction boom. In addition, the acquisition of Buzzi Unicem's Ukrainian business could make CRH the leading cement producer in Ukraine, where there will be a clear need for construction after the end of the war.

Advertising technology company AppLovin (APP) provides advertising solutions for apps and acts as a middleman between app developers and advertisers. This highly profitable company reported strong financial results on August 7, which I believe are not yet fully reflected in the stock price. Salesforce (CRM) is another great software and cloud computing company poised to benefit from AI, and recent weakness presents a great buying opportunity in my opinion.

Pharmaceutical company Verona Pharma's (VRNA) ensifentrine, approved on June 26 for the maintenance treatment of COPD, is the first new COPD drug in over a decade. I believe Verona's ensifentrine has blockbuster potential (>$1 billion in annual sales). Clinical trials are also underway for other approvals, such as in cystic fibrosis. I have held Verona for years and believe the stock is significantly undervalued. Journey Medical (DERM) is a pharmaceutical company whose candidate DFD-29 (minocycline hydrochloride modified release capsules, 40 mg) has the potential to become the drug of choice for the common skin condition rosacea. The FDA has set a Prescription Drug User Fee Act ("PDUFA") target date of November 4, 2024.

Modine Manufacturing (MOD) makes thermal management systems used in electric vehicles, various industries and, increasingly, AI data centers. The company has shown incredible growth and is still cheap with a forward 12-month PEG ratio of 0.77.

Rocket Labs USA (RKLB) builds rockets and provides launch services. Following the success of the Electron rocket, the company is developing the much larger Neutron rocket, which has the potential to become the company's cash cow with a LEO payload of about 13 tons.

AlzChem Group (ALZCF) is a specialty chemicals company based in Bavaria, Germany, that specializes in nitrogen compounds, e.g. for fertilizers. One product is nitroguanidine, which is used, for example, as a propellant for airbags. Nitroguanidine is also used as a propellant in ammunition, particularly artillery ammunition, and is therefore of increasing strategic importance. As part of the ASAP (Act in Support of Ammunition Production), the EU Commission in March approved funding of €34.4 million for Alzchem to increase production capacity for nitroguanidine and its precursors. With a P/E ratio of less than 12, a future expansion of nitroguanidine production capacity does not yet appear to be priced in.

Follow me on X for frequent updates (@chaotropy).