Why Estimates For NVIDIA's Q4 Revenue Could Be Dead Wrong: The Case for NVIDIA's Next Blowout Report

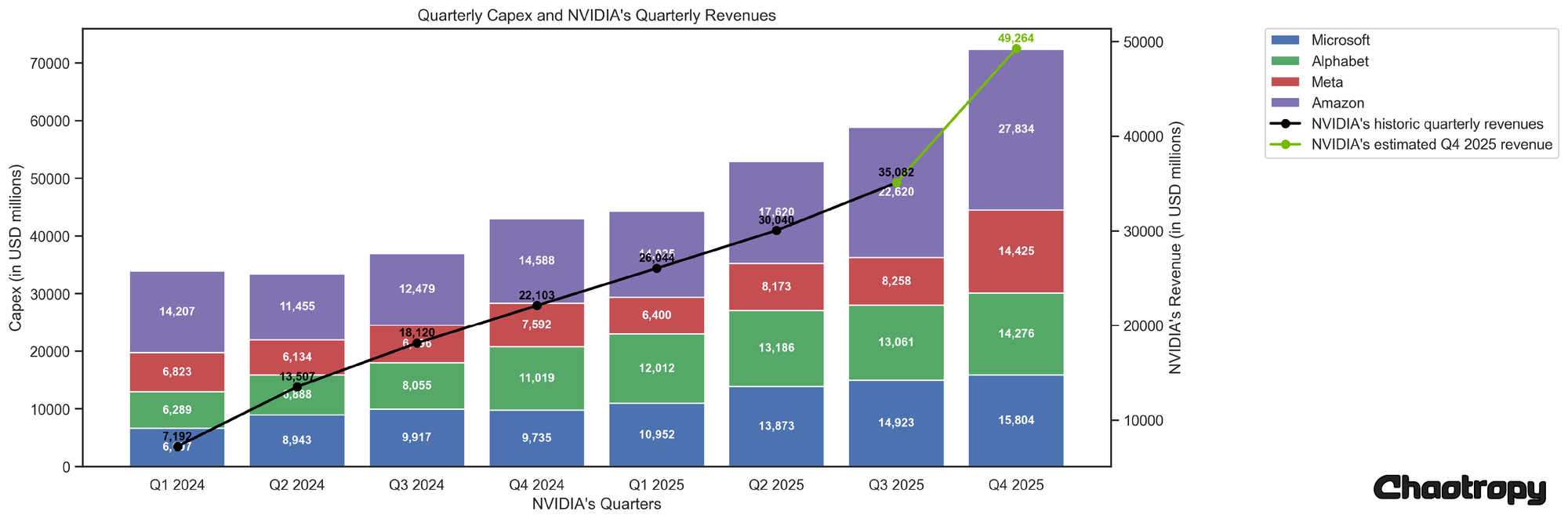

Estimating NVIDIA's Q4 2025 revenue from the capex of its four largest customers using linear regression results in an estimated revenue that is significantly higher than Wall Street's expectations.

This is the author’s opinion only, not financial advice, and is intended for entertainment purposes only. The author holds a beneficial long position in NVIDIA Corporation. The author receives no compensation for writing this article and has no business relationship with any of the companies mentioned. The following analysis has been carefully conducted, but numbers or calculations may be incorrect, leading to potentially incorrect results.

On January 31, I argued that the efficiency of DeepSeek-R1 was a bullish rather than bearish case for NVIDIA in the long run. At over 22%, NVIDIA is the largest position in the Innovation & Freedom Portfolio. I believe NVIDIA could beat expectations more than it has in a long time with its upcoming Q4 FY2025* earnings report.

*Note: Although it may sound confusing, NVIDIA is in fiscal year 2025 and will report its Q4 FY2025 results on February 26, 2025.

NVIDIA will report its Q4 FY2025 financial results on February 26. The consensus estimate for NVIDIA's Q4 revenue is $38.13 billion. In the past two weeks, Microsoft, Meta, Alphabet, and Amazon, NVIDIA's largest customers, have reported earnings. One of the biggest headlines was the announcement that these four companies plan to spend approximately $320 billion in capital expenditures (capex) through 2025:

| Meta | Alphabet | Microsoft | Amazon | Sum | |

|---|---|---|---|---|---|

| 2024 ($bn) | 39.2 | 52.6 | 75.6 | 77.8 | 245.2 |

| 2025 (planned, $bn) | 65.0 | 75.0 | 80.0 | 100.0 | 320.0 |

Much less attention has been paid to the significant increase in capex by these companies in the last reported quarter:

| Meta | Alphabet | Microsoft | Amazon | Sum | |

|---|---|---|---|---|---|

| Last quarter reported ($bn) | 14.425 | 14.276 | 15.804 | 27.834 | 72.339 |

| Previous quarter ($bn) | 8.258 | 13.061 | 14.923 | 22.620 | 58.862 |

| Change from previous quarter | +74.7% | +9.3% | +5.9% | +23.1% | +22.90% |

Since these 4 companies are the largest buyers of NVIDIA's GPUs, it makes sense to examine a correlation between these companies' quarterly capex and NVIDIA's quarterly revenue. For the last 7 quarters, we get a strong correlation coefficient of 0.95 (Pearson correlation). Now, if we use linear regression to estimate NVIDIA's revenue for the yet-to-be-reported Q4 2025 based on this data, we get quarterly revenue of $49.265 billion, which is more than $10 billion above the consensus analyst estimate.

Of course, NVIDIA's GPUs account for only a portion of these 4 companies' reported capex. However, given the recent disappointing results from NVIDIA's competitor AMD, that portion may have increased. It could also be that a lot of datacenters have been built now and these costs were already incurred in previous quarters, leaving more capex for NVIDIA's GPUs - and the newly built datacenters should now have plenty of room for the upcoming Blackwell generation. Of course, companies like Alphabet are also building their own AI chips, but they are much less cost-effective than NVIDIA's Hopper generation and especially the upcoming Blackwell generation. Or as Amazon CEO Andy Jassy put it on an analyst call last week: "most AI compute has been driven by Nvidia chips, and we obviously have a deep partnership with Nvidia and will for as long as we can see into the future." All in all, one could assume that the share of capex from these 4 companies going to NVIDIA may have even increased in the last quarter.

In addition, there are other major buyers of NVIDIA's GPUs: xAI, for example, has also purchased tens of thousands of NVIDIA's GPUs and built the massive supercomputer Colossus with 100,000 NVIDIA Hopper GPUs. Another massive buyer of NVIDIA's GPUs has just formed with Project Stargate, which plans to invest a staggering $500 billion in new AI infrastructure over the next four years. All of this should continue to be a strong wind in NVIDIA's sails.

Estimating NVIDIA's upcoming quarterly revenue based solely on the most recent quarterly capex of four of its largest customers may not be a sufficient methodology. However, this projection could be a sign that Wall Street's consensus estimate could be significantly beaten on February 26.